However, this legislation lays the groundwork for Congress to make permanent, transformative changes, including a permanent child allowance.

The American Rescue Plan’s CTC and EITC expansions are only in effect through 2021. Expands the eligible age range for recipients, allowing younger workers ages 19 to 24 as well as workers who are 65 and older to claim the credit.Raises the income limit from $15,980 per year for single filers and $21,920 for married filers to $21,427 per year for single filers and $27,367 per year for married filers.Increases the maximum value of the credit from $543 to $1,502.The American Rescue Plan expands the EITC by doing the following: Under previous law, these workers received only a very small EITC that phased out at very low income levels, and both younger and older workers were ineligible. The bill also expands the EITC for workers without qualifying children. territories to disburse CTCs through their tax codes Allows families in Puerto Rico to claim the fully refundable, expanded CTC from the IRS and provides funding for other U.S.Parents will receive monthly payments of $300 per month for young children and $250 for older children from July through December, with the remaining $1,800 for young children and $1,500 for older children disbursed early next year. Families will receive half of their CTC for 2021 in monthly installments beginning in July, 3 with the rest disbursed at tax time early next year. Provides for the advance payment of the CTC on a periodic basis.The law does not change the phaseout of the preexisting $2,000-per-child CTC, which begins above $200,000 of income for single adults and $400,000 for married couples. Limits the expansion for higher-income families by phasing out the additional $1,000 (and $1,600 for young children) for incomes higher than $112,500 for heads of households, such as single parents, and household incomes above $150,000 for married couples with children.

Increases the amount of the credit from $2,000 to $3,000 for children ages 6 to 16 and extends the $3,000 credit to 17-year-olds.Increases the amount of the credit from $2,000 to $3,600 for children ages 5 and under.

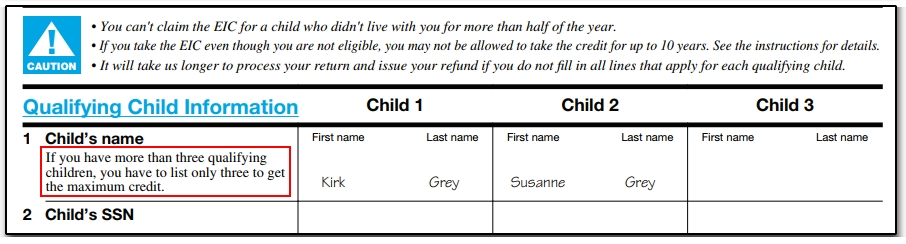

#2021 EIC TABLE FULL#

Makes the credit fully refundable for 2021, so that families receive the full amount even if they do not have federal income tax liability-as most low-income families with children do not.The American Rescue Plan temporarily expands the CTC, extending it in full to low- and middle-income families and paying out the credit periodically instead of as a single lump sum. But in order for those changes to have a long-term impact and better support families with children and low-wage workers, they must be made permanent. 1 However, the Biden administration’s American Rescue Plan, the $1.9 trillion stimulus package centered on broad emergency relief in response to the coronavirus pandemic, makes important temporary changes to the child tax credit (CTC) and earned income tax credit (EITC) that begin to solve this problem.

#2021 EIC TABLE CODE#

Many aspects of the current tax code perpetuate structural sexism and racism, and even provisions intended to support low-income people and families exclude the poorest and most vulnerable. For decades, the American economic system and other institutions meant to support economic mobility have largely failed the tens of millions of people in the country who experience poverty every year-and the U.S.

0 kommentar(er)

0 kommentar(er)